What Does a Forex Spread Tell Traders?

Categories:

Forex Basics

Course Info

Curriculum

About Course

Forex spreads explained: Main talking points

- Spreads are based on the buy and sell price of a currency pair.

- Costs are based on forex spreads and lot sizes.

- Forex spreads are variable and should be referenced from your trading platform.

WHAT IS A SPREAD IN FOREX…

Forex spreads explained: Main talking points

Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

A high spread means there is a large difference between the bid and the ask price. Emerging market currency pairs generally have a high spread compared to major currency pairs.

A higher than normal spread generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. Before news events, or during big shock (Brexit, US Elections), spreads can widen greatly.

Low spread

A low spread means there is a small difference between the bid and the ask price. It is preferable to trade when spreads are low like during the major forex sessions. A low spread generally indicates that volatility is low and liquidity is high.

A high spread means there is a large difference between the bid and the ask price. Emerging market currency pairs generally have a high spread compared to major currency pairs.

A higher than normal spread generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. Before news events, or during big shock (Brexit, US Elections), spreads can widen greatly.

Low spread

A low spread means there is a small difference between the bid and the ask price. It is preferable to trade when spreads are low like during the major forex sessions. A low spread generally indicates that volatility is low and liquidity is high.

- Spreads are based on the buy and sell price of a currency pair.

- Costs are based on forex spreads and lot sizes.

- Forex spreads are variable and should be referenced from your trading platform.

WHAT IS A SPREAD IN FOREX TRADING?

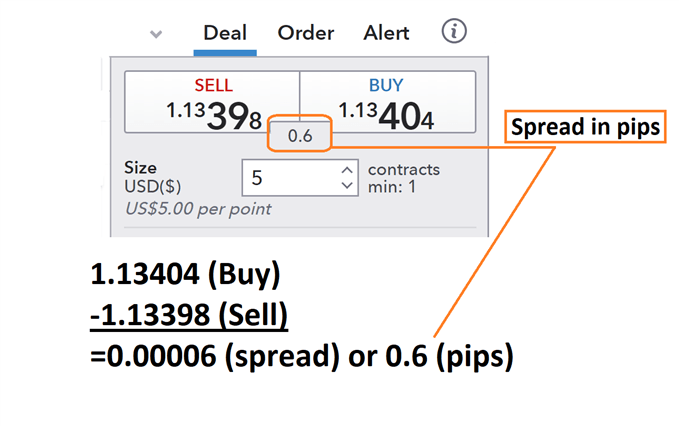

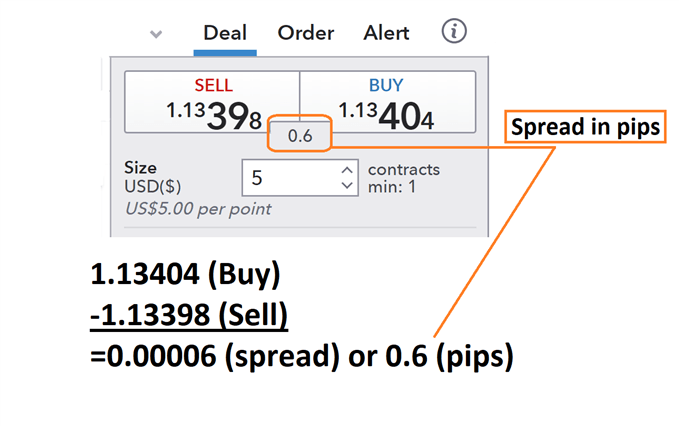

Every market has a spread and so does forex. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. Traders that are familiar with equities will synonymously call this the Bid: Ask spread. Below we can see an example of the forex spread being calculated for the EUR/USD. First, we will find the buy price at 1.13398 and then subtract the sell price of 1.3404. What we are left with after this process is a reading of .00006. Traders should remember that the pip value is then identified on the EUR/USD as the 4th digit after the decimal, making the final spread calculated as 0.6 pips. Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

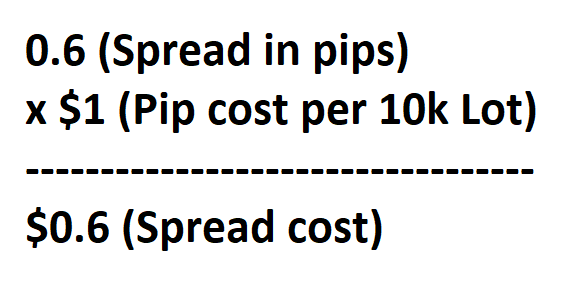

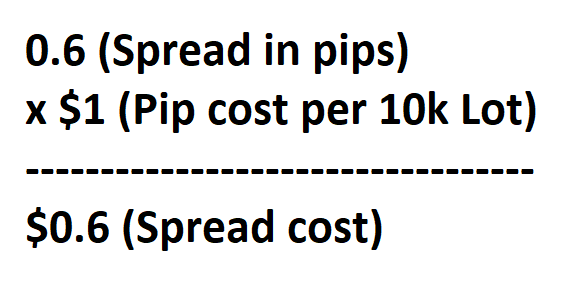

HOW TO CALCULATE THE FOREX SPREAD AND COSTS

Before we calculate the cost of a spread, remember that the spread is just the ask price less (minus) the bid price of a currency pair. So, in our example above, 1.13404-1.13398 = 0.00006 or 0.6 pips. Using the quotes above, we know we can currently buy the EUR/USD at 1.13404 and close the transaction at a sell price of 1.13398. That means as soon as our trade is open, a trader would incur 0.6 pips of spread. To find the total spread cost, we will now need to multiply this value by pip cost while considering the total amount of lots traded. When trading a 10k EUR/USD lot, you would incur a total cost of 0.00006 (0.6pips) X 10,000 (10k lot) = $0.6. If you were trading a standard lot (100,000 units of currency) your spread cost would be 0.00006pips (0.6pips) X 100,000 (1 standard lot) = $6. If your account is denominated in another currency, like GBP, you would have to convert it to US Dollars.

Start Trading Now

Start Trading Now