MARGIN CALLS IN FOREX TRADING – MAIN TALKING POINTS:

- A short introduction to margin and leverage

- Causes of margin call

- Margin call procedure

- How to avoid margin calls

WHAT CAUSES A MARGIN CALL IN FOREX TRADING?

A margin call is what happens when a trader no longer has any usable/free margin. In other words, the account needs more funding. This tends to happen when trading losses reduce the usable margin below an acceptable level determined by the broker. Margin call is more likely to occur when traders commit a large portion of equity to used margin, leaving very little room to absorb losses. From the broker’s point of view this is a necessary mechanism to manage and reduce their risk effectively. Below are the top causes for margin calls, presented in no specific order:- Holding on to a losing trade too long which depletes usable margin

- Over-leveraging your account combined with the first reason

- An underfunded account which will force you to over trade with too little usable margin

- Trading without stops when price moves aggressively in the opposite direction.

WHAT HAPPENS WHEN A MARGIN CALL TAKES PLACE?

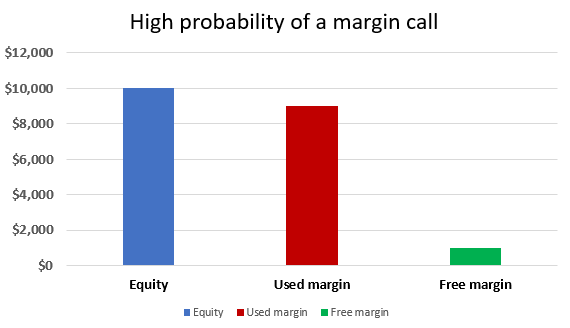

When a margin call takes place, a trader is liquidated or closed out of their trades. The purpose is two-fold: the trader no longer has the money in their account to hold the losing positions and the broker is now on the line for their losses, which is equally bad for the broker. It is important to know that leverage trading brings with it, in certain scenarios, the possibility that a trader may owe the broker more than what has been deposited. Below is a visual representation of a trading account that runs a high chance of receiving a margin call: Deposit: $10 000 Number of standard (100k lots traded): 4 Margin percentage: 2% *Used margin: $9 000 Free margin: $1 000 *The used margin is calculated as follows with the EUR/USD at 1.125:Trade size x price x margin percentage x no. of lots

$100 000 x 1125 x 2% x 4 lots = $9 000

For simplicity, this is the only position open and it accounts for the entire used margin. It is clear to see that the margin required to maintain the open position uses up the majority of the account equity. This leaves a free margin of only $1000.

Traders may operate under the false assumption that the account is in good condition; however, the use of leverage means that the account is less able to absorb large movements against the trader. In this example, if the market moves more than 25 points (not accounting for spread) the trader will be on margin call and have the position liquidated ($40 per point x 25 points = $1000).

For simplicity, this is the only position open and it accounts for the entire used margin. It is clear to see that the margin required to maintain the open position uses up the majority of the account equity. This leaves a free margin of only $1000.

Traders may operate under the false assumption that the account is in good condition; however, the use of leverage means that the account is less able to absorb large movements against the trader. In this example, if the market moves more than 25 points (not accounting for spread) the trader will be on margin call and have the position liquidated ($40 per point x 25 points = $1000).

HOW TO AVOID MARGIN CALL?

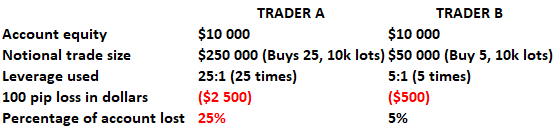

Leverage is often and fittingly referred to as a double-edged sword. The purpose of that statement is that the larger leverage a trader uses – relative to the amount deposited - the less usable margin a traderwill have to absorb any losses. The sword only cuts deeper if an over-leveraged trade goes against a trader as the losses can quickly deplete their account. When usable margin percentage hits zero, a trader will receive a margin call. This only gives further credence to the reason of using protective stops to cut potential losses as short as possible. To further reinforce the effect of leverage on a trader’s account, consider the following example where leverage is the only difference for these trades: In the end, we don’t know what tomorrow will bring in terms of price action so be responsible when determining the appropriate leverage used when trading.

Top 4 ways to avoid margin call in forex trading:

In the end, we don’t know what tomorrow will bring in terms of price action so be responsible when determining the appropriate leverage used when trading.

Top 4 ways to avoid margin call in forex trading:

- Do not over-lever your trading account. Reduce your effective leverage. At USFXT, we recommend using ten to one leverage, or less.

- Exercise prudent risk management by limiting your losses with the use of stops.

- Keep a healthy amount of free margin on the account in order to stay in trades. At USFXT, we recommend using no more than 1% of the account equity towards any single trade and no more than 5% equity on all trades at any point in time.

- Trade smaller sizes and approach each trade as just one of a thousand insignificant, little trades.

Start Trading Now

Start Trading Now